Having the extra edge could be the key to attract, service, and retain the the modern-day banking customer.

Most existing systems only provide a basic insight into the real finance profile of a client which would end up finance companies losing the opportunity to provide the right level of tailored services to them. Our Fintech offering can perform deep analytics on your client's behaviour patterns and help you uncover never before seen sending patterns, behavioural patterns and relationships which will help you take crticial decisions when it comes to offering new facilities to clients.

Check out our Fintech services product range and details below.

vxFRMS

vxFRMS, a cutting-edge financial risk management system that enables banks and financial institutions to manage all their risk segments effectively and proactively

vxAnalytics

vxAnalytics, a comprehensive end-to-end data analytics tool that provides sub-second queries on billions of data records

vxDemo

vxDemo is our newest product in the telco range and delivers fantastic demo capabilities for you to reach more clients.

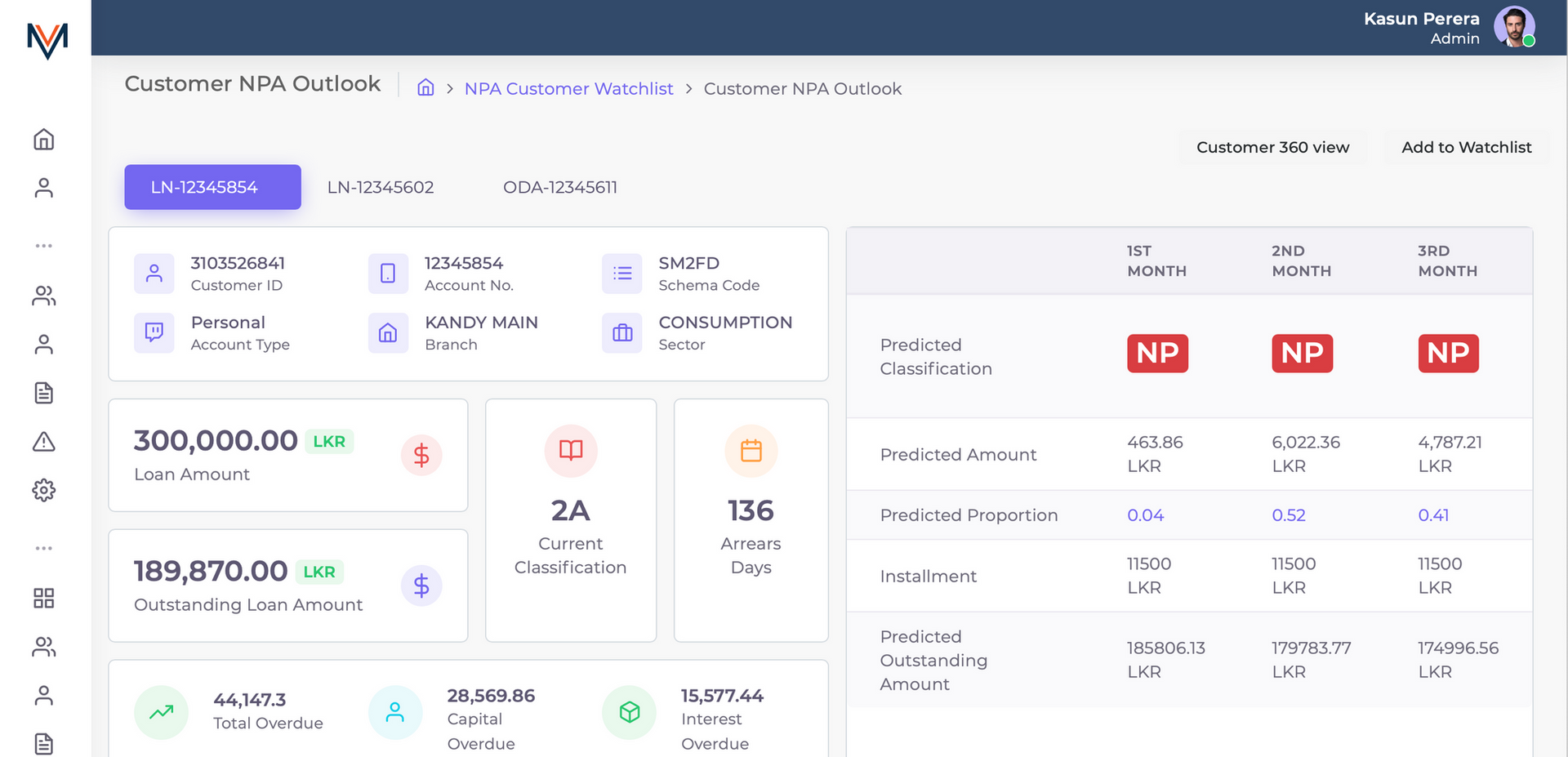

vxFRMS - the cutting-edge financial and credit risk management system by Vizuamatix - can assist all levels of management to manage their risk segments effectively and proactively by providing Early Warning Signal of risky financial sectors, operational regions, operational branches, and individual customers. These Early Warning Signals are provided by analyzing customer behavior and economical factors both local and global. One of the key specialties of the platform is utilizing machine learning to analyze the NPA customer behavior make predictions of future NPA probability with very high accuracy. These features combined provide a very powerful platform for decision-makers to take quick accurate decisions to manage their financial portfolio with minimal risk.

Rule-based Early Warning System (EWS) with vendor independent, configurable scoring modules

Predictive analytics based accurate credit risk ratings

Faster ECL implementation with an inventory of commonly used model types

A rule based and AI-powered model based Transaction Monitoring System (TMS)

An interactive UI and a workbench to perform data visualizations, analysis and model building

AI-based Non-Performing Assets (NPA) prediction / ability to visualize portfolio NPA trends over time.

What can vxFRMS do for you?

Helps in loan disbursement decisions. It can integrate with third-party systems. E.g. central credit rating systems to check the borrower’s financial health

Helps in loan disbursement decisions. It can integrate with third-party systems. E.g. central credit rating systems to check the borrower’s financial health

Prevents exposure with defaulting borrowers by monitoring borrowers and their portfolios backed by substantial explanations.

Given the volatility of the environment, stakeholders need constant reassurance that their expectations of good-quality low-risk loans can be met. Effective monitoring can lower loan-loss contingency by 10% to 20%. Institutions with sound credit-monitoring practices have a strong risk appetite, a higher return on equity, and a better capital yield. Achieve all of these with vxFRMS.

CORE FEATURES

ADDITIONAL FEATURES

Holistic 360 degree view of a customer's data including credit history, warning signals and product portfolio at a glance

Visualize complex networks of relationships and risk propagation between entities and linked accounts

Out-of-the-box visualizations and analytics for informed business decisions

Facilitate to maintain an intuitively selected lists of customers for close monitoring

User friendly and efficient framework for Issue creation, user and action assignment and smooth management between different teams.

Support generation of standard and customised reports

Integration with internal and external data sources and in to existing infrastructure

In-house data science capabilities for continued enhancements / Detailed chronological reports for traceability of work processes

Convinced that vxFRMS can help your organization better understand your customers and it will help you improve the quality of services?

Let us know more details for a demo.

VISION BEHIND vxANALYTICS

Are you not utilizing your data properly (or at all)?

Are you passing up opportunities to serve your customers?

Do you require more potent solutions?

Are you concerned about the cost?

Do you have a strong desire for capacity?

Are you concerned about compatibility?

Your data is invaluable – but only if you can put it to use. Your organization needs to master the three ‘Vs' of big data which are Volume, Variety, and Velocity, and turn it into actionable information.

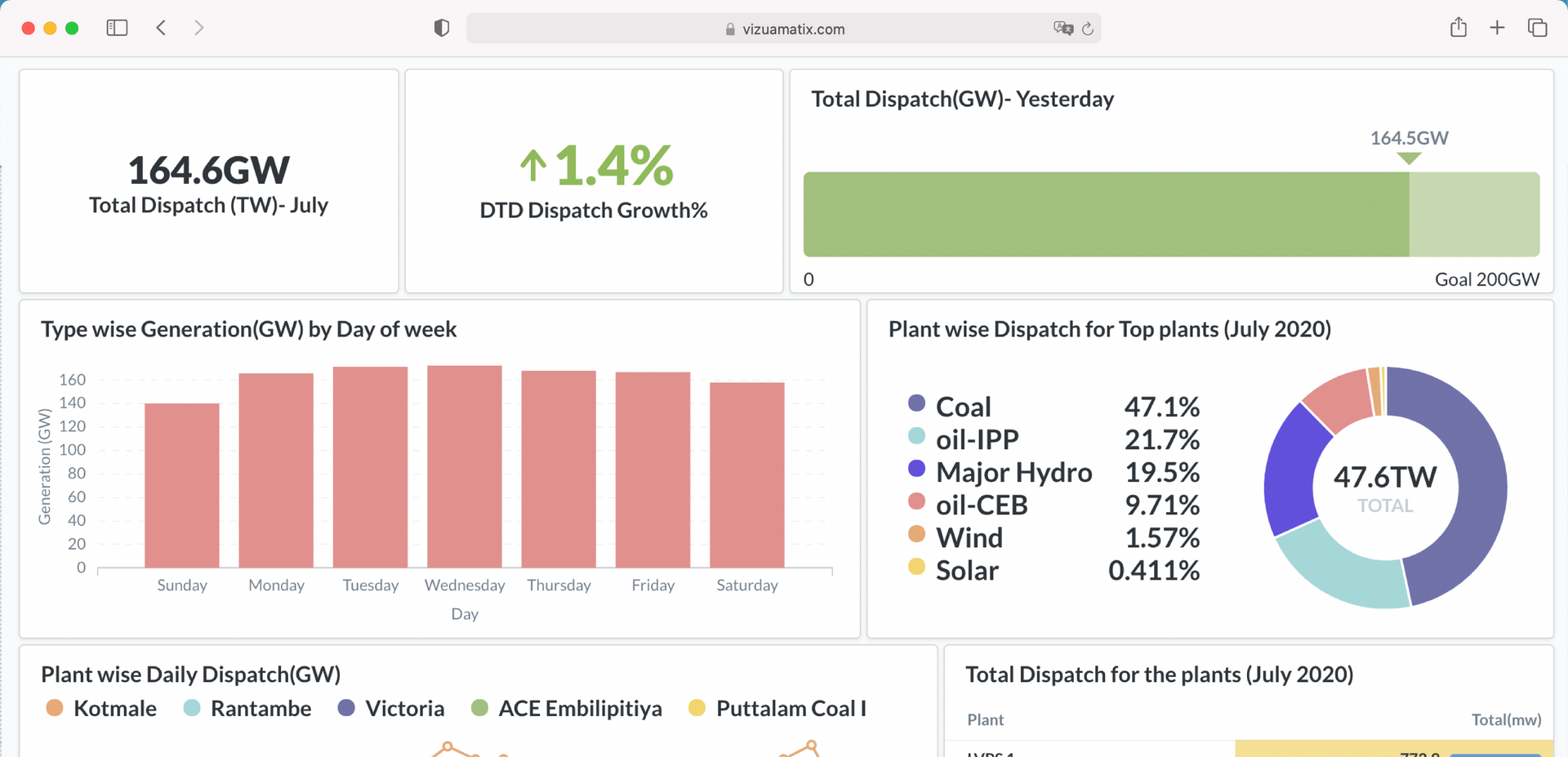

vxAnalytics, a comprehensive end-to-end data analytics tool that provides sub-second queries on billions of data records. It is purpose-built using contemporary, high-performance cluster computing technologies and frameworks to deliver extremely efficient, advanced analytics, visualizing your Big Data and turning it into meaningful and profitable information.

Volume

Variety

Velocity

WHY CHOOSE vxANALYTICS

SEAMLESS INTEGRATION

Stop worrying about huge system overhauls; vxAnalytics integrates with your existing systems.

INTUITIVE VISUALIZATION

Obtain results that you can analyze and act on.

HIGHLY SCALABLE

Is your big data growing? vxAnalytics evolve alongside you.

PATTERN RECOGNITION & MACHINE LEARNING

Intelligent analytics can identify trends in your data without you having to point them out.

REAL-TIME ANALYTICS

Why delay? Receive updates as they occur.

CONFIGURE TRIGGERS FOR KPIS

Be notified when action is required.

This is the vxDemo product description

This is the vxDemo product description

This is the vxDemo product description

This is the vxDemo product description

This is the vxDemo product description

This is the vxDemo product description

This is the vxDemo product description

This is the vxDemo product description